Overcoming the Fear of Retirement

Posted on: 4th September 2019 in

Retirement Planning

Hippopotomonstrosesquipedaliophobia. Ironically this is the term used to describe those that have a fear of long words.

There seems to be a tongue-twisting word to describe every fear imaginable, but what do you call someone who has a fear of retirement? Well, there doesn’t seem to be one but it is a genuine fear for some and the figures prove it.

According to the

Pension and Lifetime Savings Association, just over 30 million working age people fear they have too little saved.

How much does it cost to retire?

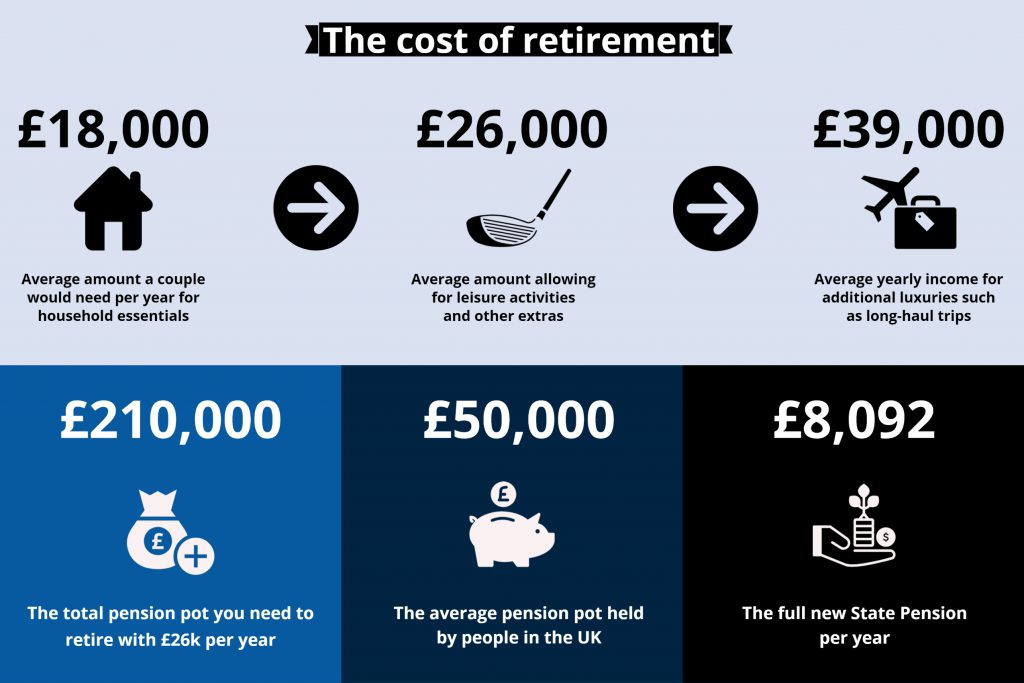

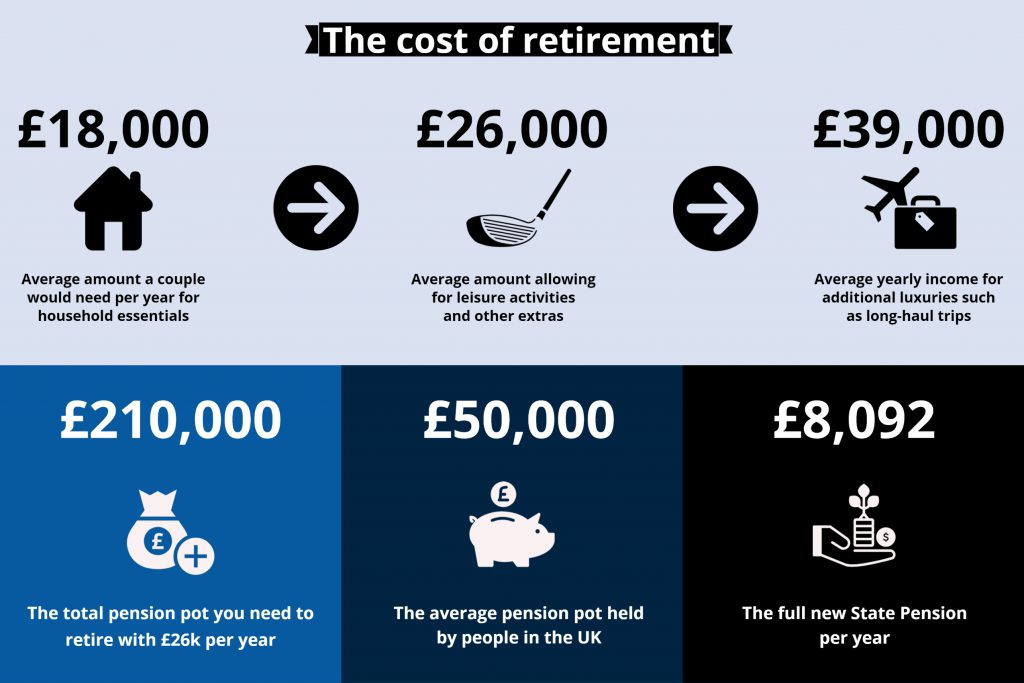

Very few things in life are free and enjoying your retirement comes at a price. Looking at the figures, it’s not hard to see why so many are worried about their financial future.

The fear effect

Running out of money seems to be the root cause for people’s fear of retirement.

Many expats move to the UAE with good intentions – to earn money and save for the future and maybe even retire early. It can be easy to lose sight of your goal and for some, it seems the dream of early retirement might be slipping away.

A 2017 survey carried out in the UAE found that 43% of respondents expected to retire between the ages of 50-55. That figure dropped to 35% in 2018 with more people expecting to retire later in life.

It’s the same story in the UK. The Office of National Statistics revealed that 10.2% of those aged 65 and over were still working in 2018. To put this into context, that figure stood at 5.5% when data was first collected in 1992.

Expats may still be entitled to a

UK State Pension but it’s unlikely to the full amount. Even at the maximum rate of £8,092, the State Pension is rarely enough to support you through retirement as a sole means of income.

What is the solution?

Unfortunately, there is no quick fix or short-term solution, the key is to play the long game. Have a plan and stick to it.

What comes to mind when you think of ‘

retirement planning’? It’s actually quite a broad term.

Fundamentally it means having clear retirement goals and a plan of action in place to meet those goals.

Whether it’s saving into a private pension or investing your money, retirement planning is certainly not a one size fits all.

Remember, the UAE is a pension-free country and expats can fall into the trap of not planning for their retirement properly. Retirement planning starts long before you actually retire and it’s certainly never too early to start. The truth is, the sooner you start the better off you will be.

Retirement planning: Where to start

The choices you make and the steps you take towards your retirement planning are crucial and can shape your income for the rest of your life. Here are four steps to get you started.

1. Set goals

Before you start your financial planning, you need to set yourself some clear goals.

How much do you need to enjoy the lifestyle you want when you retire? This will ultimately be the question you need to ask yourself.

Knowing what you are working towards means you can set up a bespoke plan to achieve your financial

goals.

2. Create a budget

Rent is one of the biggest expenses for expats in the UAE and if you have children it can put further strain on your income.

You might be scratching your head when it comes to setting money aside for your retirement – this is where budgeting comes in.

Creating a budget will show you where your income comes from and how you spend it. It will also encourage you to think about changes you might need to make when you retire to live comfortably.

Whether you use an online tool or just write it down, a budget is a great way to identify or free up some cash to save.

3. Consider your options

Expats need to weigh up their options if they plan to retire abroad, especially when it comes to pensions.

A qualified recognised overseas pension scheme (QROPS) allows you to move a UK pension overseas and can include tax-free transfers. Another benefit is having your pension paid in the local currency which protects it from fluctuations in exchange rates.

For those looking for more control over their pension investments there are self-invested personal pensions (SIPPs). This type of pension allows you to pick the areas that you would like to invest in which is a great option for a seasoned investor.

4. Make a start

The amount you need for your retirement will depend on the lifestyle you expect to lead and other factors. For example, you may have outstanding debts such as your mortgage still to pay off.

Experts suggest that your retirement income should amount to 80% of your final pre-retirement yearly salary. This will include your income from private pensions, investments and State Pensions if applicable.

The sooner you start saving for your retirement the better off you will be. Putting even a little away each month will get you closer to your retirement goal.

The bottom line

As we said before, there is no official term to describe someone who has a fear of retirement.

Maybe there doesn’t need to be. Your post-working years should be a time to enjoy life and with the right retirement planning, it doesn’t need to be something to worry about.

Our specialist financial advisors have a wealth of experience in helping people achieve their financial retirement goals. If you would like to explore your retirement planning options you can contact us below.